Here’s something that’s going to come as a shocker: every investor wants to make the most money possible with their investments.

Crazy, right? However, this drive actually pushes some investors away from making the right decisions when it comes to their portfolio.

One of the concerns we hear from many investors is that they fear getting trapped or locked into a maturity when interest rates are expected to rise in the next year or so.

Naturally, these investors are looking to increase and maximize their high return investments, and since current rates are sitting at near-record lows, they are justified in thinking that these rates will rise in the near future.

The Fixed Income Fund takes the concerns surrounding inflation and increasing interest rates and flips them on their head.

Our inflation-business strategy works to maximize your income no matter what. Keep reading to learn more and contact Tactical Wealth today to learn more about the Fixed Income Fund.

Using Laddered Maturities

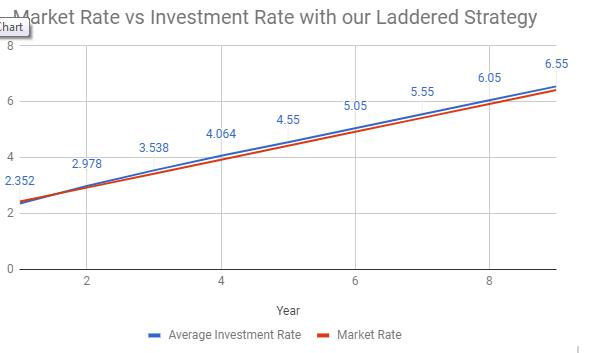

Our strategy is to use laddered maturities with a sliding scale approach to always stay ahead of the market rate increases.

Let’s take a look at an example, shall we?

Say an investor is considering a three-year maturity, which currently pays interest at 2.42 percent. Investors like these short, three-year maturities since they have the chance to adjust and re-invest when interest rates inevitably increase in three years.

However, this method actually causes investors to lose out on potential gains, as they will always be playing catch-up and trailing the current market rate. That’s exactly what any savvy investor is trying to avoid.

Rather than investing in a single three-year maturity at a time, our laddered Fixed Income Fund strategy breaks that investment into five individual maturities which cover one, two, three, four, and five-year periods.

Together, those maturities average a three-year duration, and as each of the shorter investments matures it is renewed at the back of the line with the longer five-year maturity period — which maximizes returns and also provides a higher interest rate.

That means at any given year, there are five maturity holdings which all average a three-year maturity duration, but they are staggered and each earn interest at the newest, five-year rate.

Still confused? Don’t be. Check out the information below to learn more and contact Tactical Wealth today to get a free report that applies to your situation.

How It Translates

So how do all of these sliding, laddered maturities actually translate into your investment account?

When compared to other strategies, the Fixed Income Fund has the ability to address the issue of inflation and rising interest rates by staying ahead of market rate increases. Our laddered maturity structure actually allows investors to earn more than the market interest rates without any drop-off, which is the ideal scenario for any investor.

Broken down into dollars, rather than percentages, it’s still clear to see that a laddered sliding maturity structure still beats investing in one single maturity at a time. With the Fixed Income Fund, you could be making significantly higher gains while staying ahead of rising market interest rates.

Contact Tactical Wealth today to make an investment in the Fixed Income Fund — it’s a high return investment you can count on for years to come.

Contact Tactical Wealth today to make an investment in the Fixed Income Fund — it’s a high return investment you can count on for years to come.