At Tactical Wealth, we’ve discovered that many investors, clients, and in some cases even agents, don’t fully understand the complexities or risks involved with annuities, bonds, and other securities.

That lack of understanding can lead to poor investments, high risks, and even a loss of capital and valuable assets. It can even ruin your retirement or quality of life.

That’s why we created the simple, easy-to-understand Tactical Wealth Fixed Income Fund.

The Fixed Income Fund is different in that it deals in the oldest and largest asset there is: Real estate.

We pursue and buy mortgage and trust deed loans that meet our stringent requirements, and then pay out stable, consistent income to our investors in the form of a fixed interest rate that never fluctuates with the market.

With the Fixed Income Fund, you get locked into a rate throughout the maturity of your note, from two years to 30 years, and can always count on a monthly cash payment deposited directly into your account with no additional fees.

Sound too good to be true? Well, it isn’t.

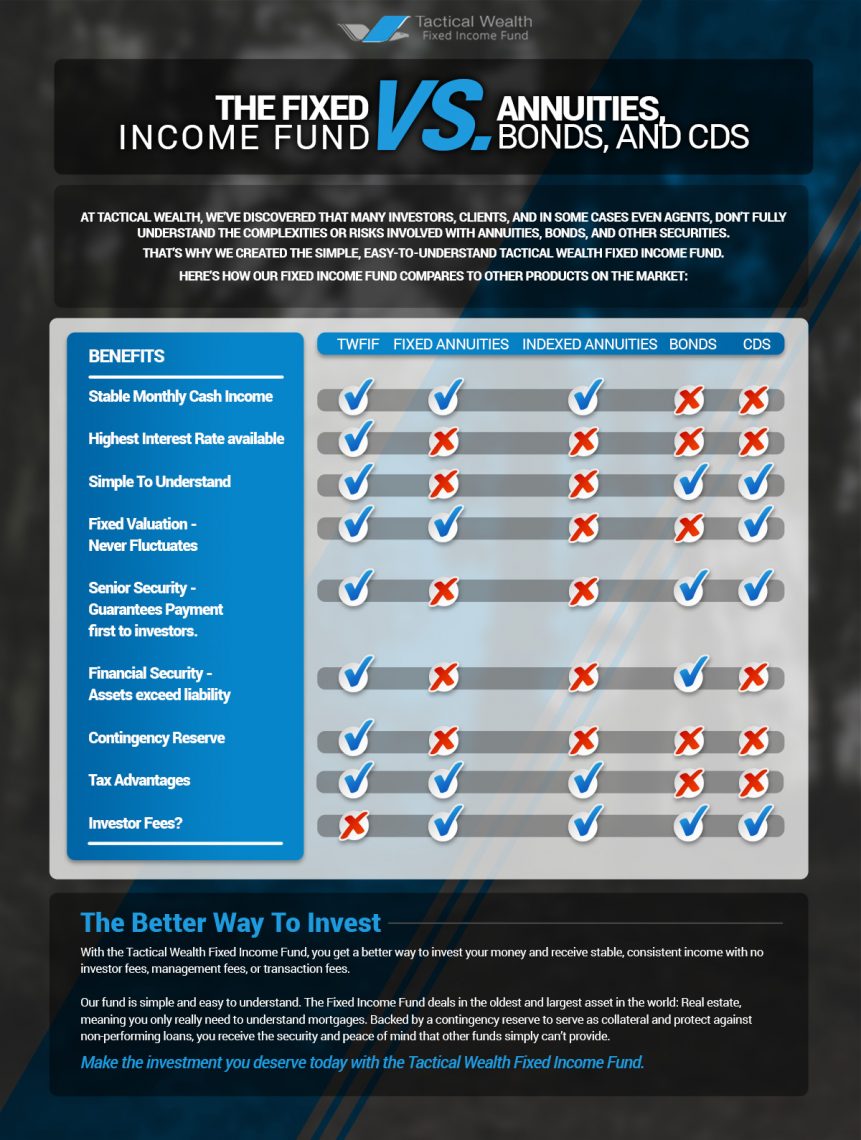

Here’s how our Fixed Income Fund compares to other products on the market:

Fixed Income Annuities

One common way to invest in a fixed income option is through annuities, which are tied to the performance of individual insurance companies or other corporations.

However, these annuities include several risks, as well as confusing terms, penalties, and payouts.

Disadvantages of annuities include:

- Low, fluctuating interest rates.

- Difficult to understand.

- No guaranteed payment to investors first.

- Assets don’t always exceed liabilities.

- No collateral in the form of tangible assets.

- Fees and penalties.

Bonds and CD’s

Other popular investment vehicles are bonds and CD’s.

However, these types of investments are slow-building, and often offer a smaller return on investment than is possible with a fixed income investment.

Bonds are often issued by local or federal municipalities or governments, and include low interest rates, fluctuating valuations, no tangible assets and no tax advantages.

CD’s, meanwhile, are often issued by banks or other financial institutions. While they do maintain their interest rate and value throughout their lifespan, CD’s don’t offer you to reap the benefits in the form of stable monthly payments, as your money is tied up until the CD is fully mature.

Additionally, there are no tax advantages or collateral that the investor can take back in the event of a default.

The Better Way To Invest

With the Tactical Wealth Fixed Income Fund, you get a better way to invest your money.

With our innovative tactical investment strategy, you receive stable, consistent income with no investor fees, management fees, or transaction fees.

Our fund is simple and easy to understand.

With the Fixed Income Fund, you get all of these things and more:

- A constant monthly income stream, paid in cash.

- High interest rates that will never fluctuate.

- Simple to understand terms and conditions.

- Constant valuation that never changes with interest rates or the stock market.

- A Senior Security which guarantees payment first to investors.

- Financial security and tangible assets with pooled investments and a contingency reserve.

- Assets that exceed liabilities.

- Tax advantages.

- No investor fees…EVER!

The Fixed Income Fund deals in real estate, meaning you only really need to understand mortgages.

That’s something 99 percent of people, including our clients, understand.

Backed by a contingency reserve to serve as collateral and protect against non-performing loans, you receive the security and peace of mind that other funds simply can’t provide.

Don’t waste time with annuity contracts, bonuses and deferrals, penalties, and other confusing terms and conditions.

Make the investment you deserve today with the Tactical Wealth Fixed Income Fund.